Royalty Statements:

A Guide to Understanding the Numbers

When a company licenses the rights to use another company’s or individual’s intellectual property (IP), the licensee typically agrees to calculate and pay royalties, which are fees based on the monetization of the IP.

A royalty statement summarizes sales activity and corresponding amounts due for that activity. To the untrained eye, these statements may be confusing or difficult to interpret.

In this guide, we’ll break down everything you need to know about royalty statements—their purpose, how to format and read them, and how to automate the royalty statement process for greater efficiency.

What Is a Royalty Statement?

Royalty statements ensure transparency between a licensor and licensee.

Professional royalty statements get generated automatically with perfect formatting through our online portal system.

The licensor is the creator or owner of the IP. Examples of licensors include:

- Authors

- Inventors

- Musicians

- Game developers

- Course creators

- Illustrators

- Brand creators

- And other creative and scientific professionals

The licensee is the entity that monetizes the creation. Some licensees include:

- Book publishers

- Pharmaceutical, biotech, or other life sciences companies

- Record labels

- Video game publishers

- Online learning platforms

- Consumer product companies

- And other companies that manufacture, sell, and/or distribute end products

Issued by the licensee, the royalty statement provides details about the income earned, deductions made, and the net amount due to the licensors. Royalty statements are created on a regular, agreed-upon schedule, which can be as frequent as every month or as infrequent as once per year.

A well-formatted royalty statement allows licensors to track their earnings and verify the accuracy of their payouts.

You can think of a royalty statement as a financial report card that shows how your work is performing in the marketplace.

How Do You Format or Read a Royalty Statement?

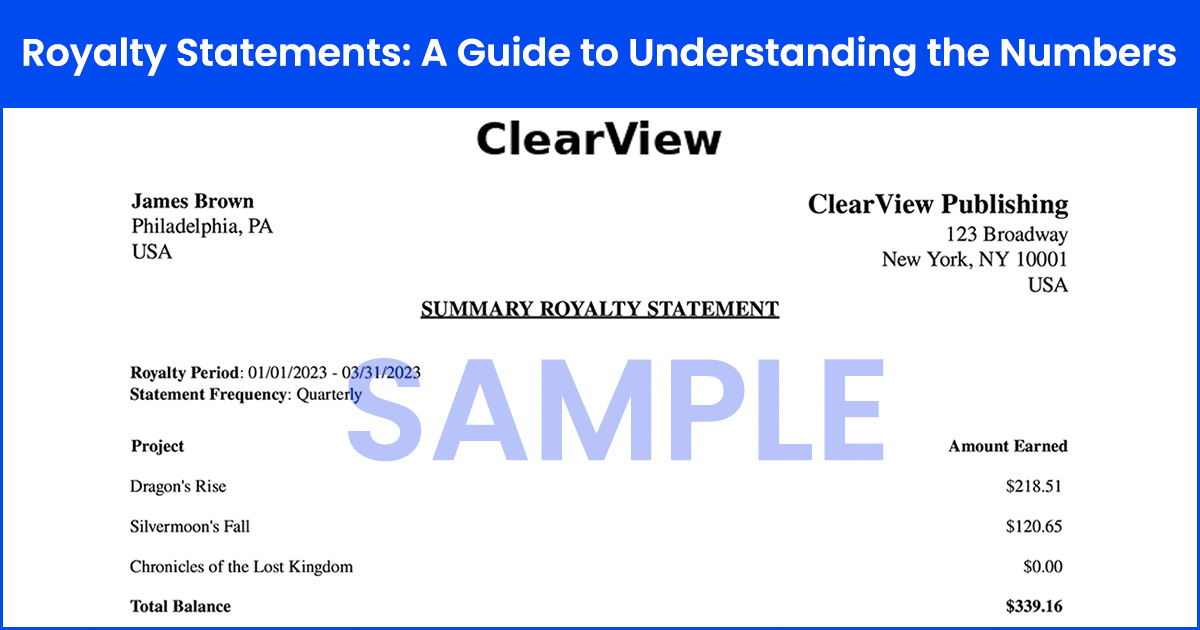

There are two main sections to a royalty statement: the Financial Summary, which provides the bottom-line information about the royalty earnings that may be due, and the Sales Detail, which explains how those earnings were calculated. There may be additional useful information in the statement as well. Let’s first walk through the basics: the items that absolutely must be included in a royalty statement.

Licensor Information: At a minimum this should include the licensor’s name, but it’s also useful to include their contact details and in some instances, basic contract information.

Licensee Information: Again, this should at least include the company name, but additional contact information is preferable.

Royalty Period: Specifies the time frame covered by the statement.

Financial Summary

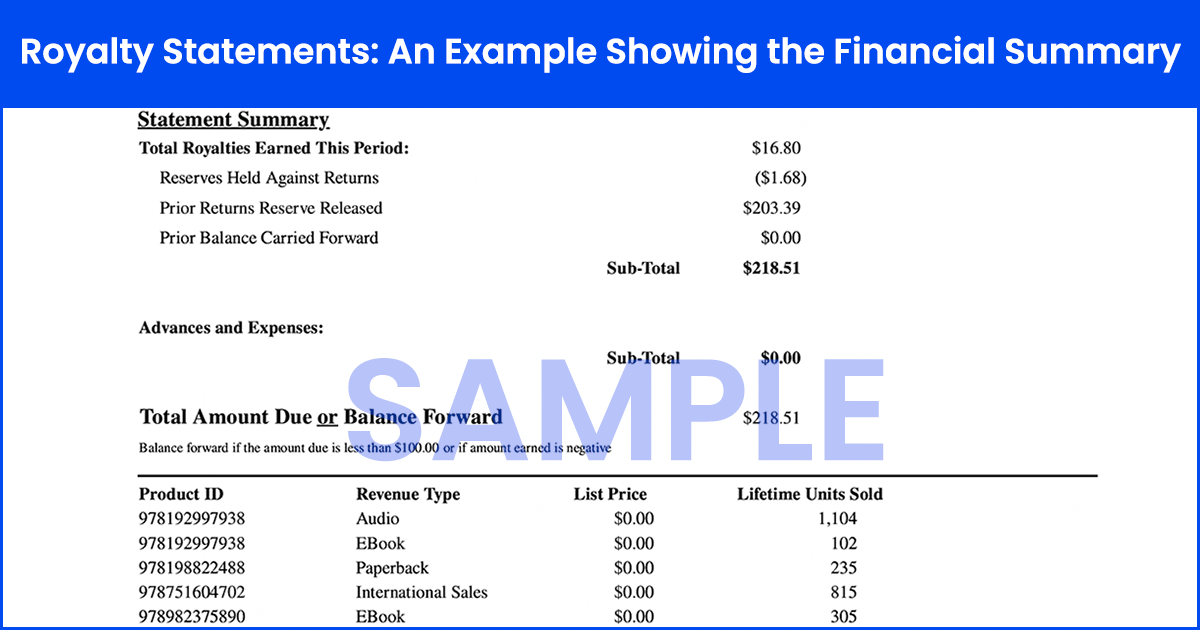

Balance Forward: The amount carried over from the previous period, which may include unpaid balances or advances that have been previously paid.

Some contracts include a minimum payment level, meaning that if a balance due within a royalty period is below a certain threshold (say $100) then the balance will be carried over until the next royalty period or until the minimum payment level is met.

Royalty Earnings: Details the income generated from sales or other uses of the property.

Deductions and Adjustments: Costs subtracted from earnings, such as production expenses, taxes, distribution fees, advances, minimum guarantees, and pre-paid royalties.

Total Balance: The total amount due to the rights holder after all earnings and deductions are accounted for.

If the advance earn-out point has not yet been met, the balance may appear as a negative number. This does not mean that the licensor needs to pay the licensee, but that this number must be met in a future royalty period in order for royalty payouts to be triggered.

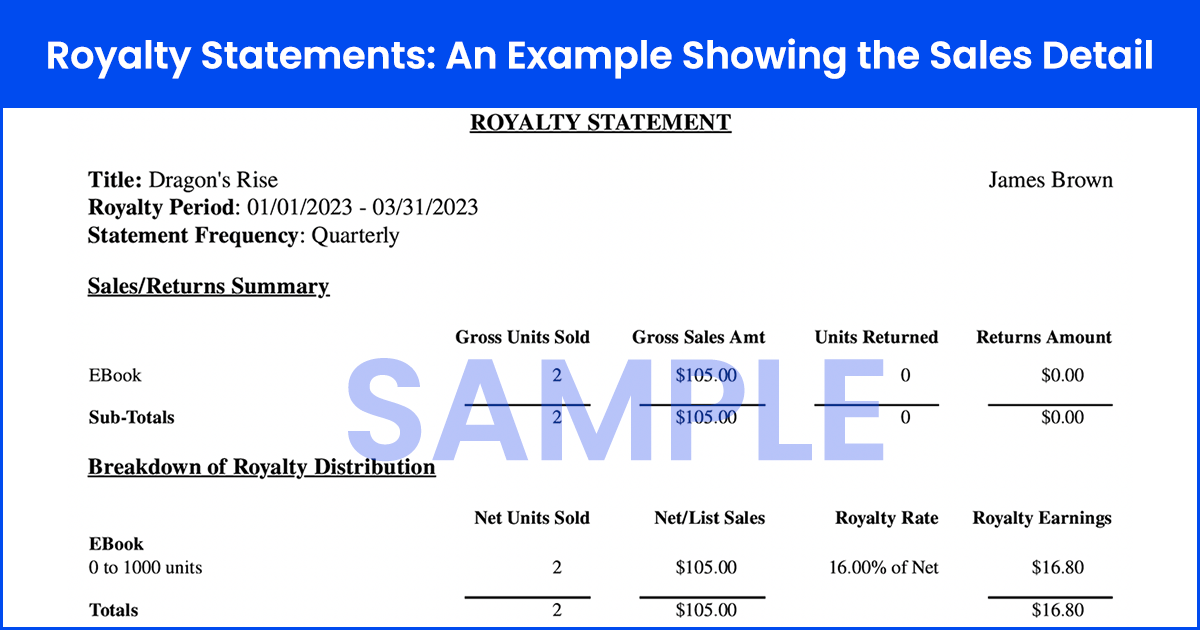

Sales Detail

Sales Data: The sales data may appear in various forms, depending on the industry and the contract terms. It might include:

- Units sold

- Product formats

- Sales by territory or market

- Income from translation rights

- Direct sales vs. distributor sales

- Retail price

- Gross revenue

- Returns

- Expenses associated with sales

- Net revenue

However the sales data appears, it should provide the information needed to apply the royalty rate and determine the amount of royalties due for the period.

Royalty Rate: The percentage of revenue allocated to the rights holder.

Royalty Earnings: The calculated earnings for the period, as determined by the sales data and royalty rate.

Optional Information

This is some of the other information that is commonly seen in royalty statements.

Statement Frequency: It’s often helpful to include a reminder of how often royalty statements are generated and distributed.

Reserves Held Against Returns: In some businesses, the licensee is responsible for reimbursing sales outlets for unsold products. In those cases, the licensee may hold some sales earnings in reserve until after the return window has ended, rather than paying out royalties immediately and then requiring a chargeback later. If that’s the case, those reserves will be noted on the royalty statement.

Prior Returns Reserve Released: Once the return window has closed, the licensee will release the above-mentioned reserves for payment. Those will be noted here.

Advance or Advance Recoupment: On some statements this will appear in its own section, rather than being included in the Balance Forward. An “advance” may also be known as a “minimum guarantee” or “pre-paid royalties.”

Lifetime Units Sold: It can be useful to supply historical sales information on the royalty statement for reference purposes.

Other communications: Since royalty statements are a regular vehicle for communications between the licensee and licensor, some licensees find it useful to include a space on their statement template for additional information, news, and updates.

There may be additional information on a royalty statement as well. For example, the Book Industry Study Group (BISG) has issued a Proposed Standard Royalty Statement which includes many additional data points related to book publishing agreements.

Eliminate Royalty Statement Errors Forever!

MetaComet® Ensures Perfect Accuracy.

Stop worrying about calculation mistakes and formatting inconsistencies in your royalty statements. Our automated system delivers error-free statements in a professional format every time. Schedule your consultation today.

What Are Some Common Errors in Royalty Statements?

Royalty managers can create their own royalty statement templates and calculate royalties in spreadsheets or accounting software. But performing royalty calculations manually or in an unsuitable system is time consuming and leaves room for human and machine errors. Some of the most frequent mistakes in royalty statements include:

- Incorrect application of sliding scales

- Erroneous calculations against advances

- Inaccurate return management

- Incorrect reserve calculations

- Failure to release reserves

- Not allocating all the sales line-items

- Misallocating sales line items

- Improper balance carry-overs

- Improper deductions

- Incorrect calculations due to errors in spreadsheet formulas

- Errors in data entry

- Delayed statement and payment delivery

6 Steps to Automating Your Royalty Statements

Is it time for you to streamline and improve your royalty payment process? If so, here are the steps to take:

1. Choose Your Software: Select a royalty accounting system that fits your needs. Consider the following as you make your decision:

- The vendor’s experience with royalty management and your industry and business model.

- How easy it is to implement, use, and integrate the product with your other business systems.

- The vendor’s reputation for customer support and success.

- Whether the product has qualified for any security certifications, such as SOC 2 Type II.

2. Integrate with Existing Systems: Determine how you will move product, sales and financial information between your royalty and other software systems.

3. Set Up Templates: Choose or create royalty statement templates that match your royalty structure.

4. Input Data: Load in your contract and sales data.

5. Generate Statements: Use the software to automatically generate your statements.

6. Review and Distribute: Review the statements for accuracy and distribute them to your rights holders.

How Can MetaComet® Help?

Understanding royalty statements is essential for tracking earnings and ensuring fair compensation. By familiarizing yourself with key components, such as sales data, royalty rates, and deductions, you can confidently interpret your financial reports. Additionally, using automation tools can simplify the process, reducing errors and improving efficiency.

MetaComet® software is designed specifically to optimize your royalty management and automate your calculations, reporting, and statements. We’ve created the easiest system to onboard and use, and our team is dedicated to customer success—so much so that over 1/3 of our new business comes to us through referrals. Our proven implementation process ensures that there will be no surprises along the way.

Are you ready to learn how MetaComet can cure your royalty headaches? Contact our sales team today for a free, custom consultation. We’d love to speak with you.

David Marlin is the President and Co-Founder of MetaComet® Systems, a prominent provider of royalty automation tools. Since founding the company in 2000, David has spearheaded the development of a suite of best-in-class systems that effectively facilitate royalty processes for nearly 200 publishers. David has also served as the chair for The Book Industry Study Group’s Rights Committee and Digital Sales Committee.

Before establishing MetaComet Systems, David served as a technology consultant for renowned publishers, collaborating with notable companies such as Random House, Penguin, HarperCollins, Holtzbrinck, Macmillan, Scholastic, Time Warner, and many others. David holds both an MBA and a BA from Columbia University in New York.

Contact Us

"*" indicates required fields