Royalty Accounting 101: How Royalties Impact Your Business

Royalty accounting can be a complex business. Numerous sources of sales, intricate contract clauses, complex calculations and multiple payments mean it can be easy to feel overwhelmed. Don’t worry; you’re not alone! This article will help you understand exactly how royalty systems affect your business’s cashflow and value.

If you’re looking for an immediate solution, MetaComet’s Royalty Tracker® automates all your complex royalty accounting calculations instantly.

How Do You Record Royalties in Accounting?

The 5 Steps of Royalty Accounting

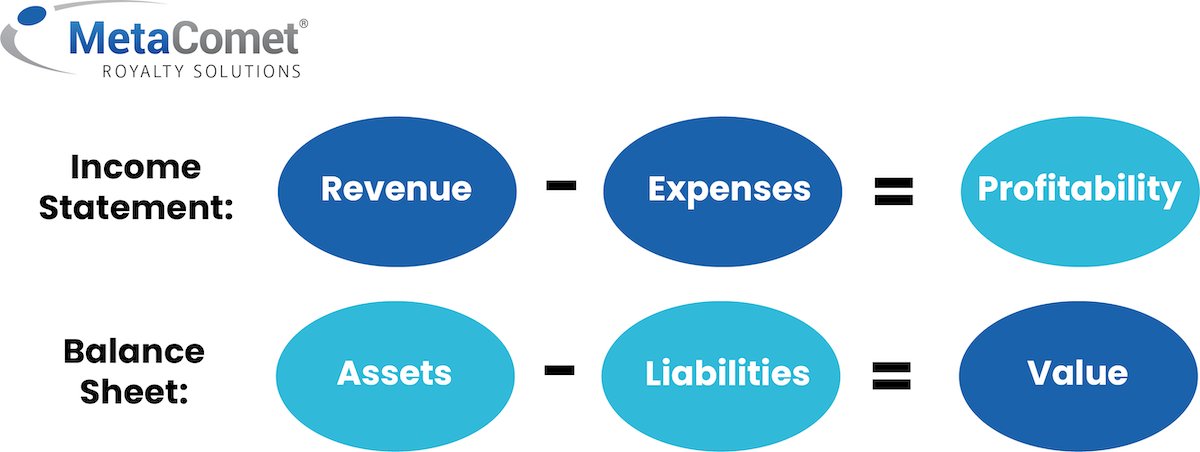

There are two basic royalty accounting statements that can illustrate the impact of transactions like royalties on your business. First, there are income statements, which will show how they affect your company’s profitability. Second, there are balance sheets, which will show how they affect your company’s value.

Each of these statements has two key elements. Income statements comprise of revenue accounts, which show the money coming in to your business; and expense accounts, which show the money going out. The difference between the two is your profitability. On a balance sheet, there are assets – the things that add value to your business, like cash; and liabilities – the things that detract value from your business. Liabilities include royalties that are due to be paid.

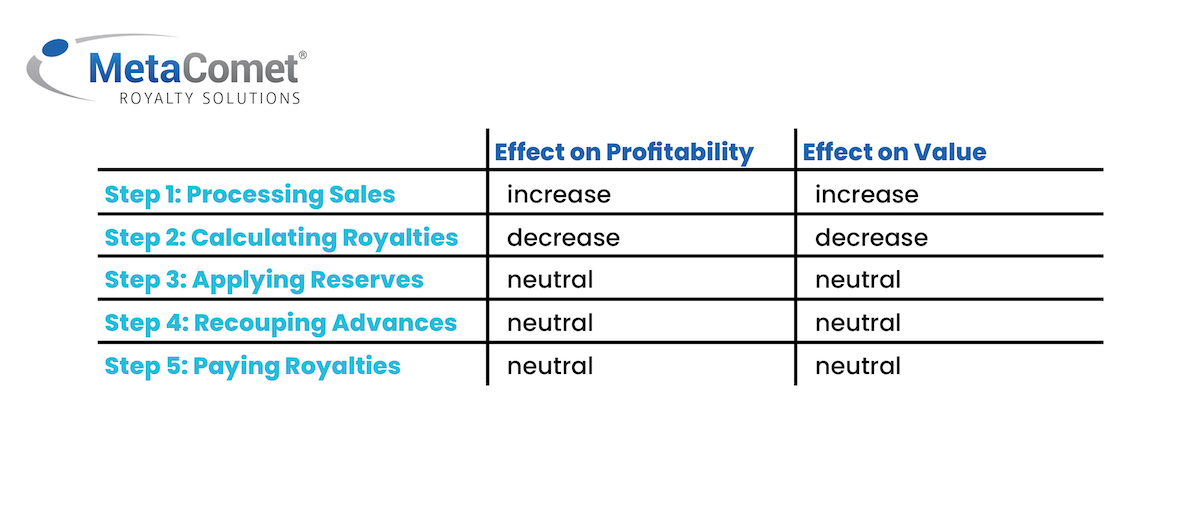

All of your financial transactions make a difference to your accounts – but it’s not always clear whether they increase or decrease the value of your business. To help understand this better, let’s take an example of royalty accounting in five steps.

Step 1: Sales

One of your books – we’ll call it The Guide to Better Royalty Management – is selling well. Your distributor has told you that it has sold 10,000 copies and earned $100,000 in revenue. This has two implications for your accounts:

- Increase (debit*) Accounts Receivable by $100,000. This is the money that is owed to you, but that hasn’t yet been paid. It’s an asset, so it increases the value of the business on the balance sheet.

- Increase (credit*) Sales by $100,000. Sales is a revenue account, meaning this also represents an increase to profitability.

Step 2: Calculating royalties

Now for the royalty part. Let’s assume you pay a royalty rate of 10%. This means the author royalties owed for The Guide to Better Royalty Management total $10,000. This has two implications for your accounts:

- Increase (debit) Royalty Expense by $10,000. This expense account item represents a decrease to your profitability.

- Increase (credit) Accrued Royalty by $10,000. This is money you owe, so it decreases the value of your business on the balance sheet.

Step 3: Reserves

At this point, you may need to apply reserves against possible returns of your books. Assume you withhold 20%, or $2,000. In this case, the impact to both your company value and your profitability is neutral. You are just moving money from one type of liability to another:

- Decrease (debit) Accrued Royalty by $2,000

- Increase (credit) Royalty Reserve Payable by $2,000

Step 4: Recouping advances

If you have paid out advances, you will now recoup those. Let’s assume you have paid a $1,000 advance. The implications are:

- Decrease (debit) Accrued Royalty by $1,000. This is $1,000 less in royalties you need to pay. You have reduced your liability, which increases your company’s value.

- Decrease (credit) Pre-paid Royalty – where you would have originally recorded the advance – by $1,000. This is a decrease to an asset, as the author now owes you less.

This is another neutral transaction. Recouping an advance doesn’t impact your value or your profitability. You don’t have to pay the author as much – but they don’t owe you as much either.

Step 5: Payments

Now let’s see what happens when you pay out royalties, based on the sale of 10,000 copies. The first thing to do is move the royalties owed from the ‘owed’ bucket (Accrued Royalty) to the ‘ready to pay’ bucket (Royalty Payable). This doesn’t impact your company’s value or profitability, because we are just shifting money from one type of owing to another:

- Decrease (debit) Accrued Royalty by $7,000 ($10,000 royalty less $2,000 reserve for returns less $1,000 advance)

- Increase (credit) Royalty Payable by $7,000.

Now we pay the author. Here’s the relevant transaction:

- Decrease (debit) Royalty Payable by $7,000. Once the payment is made, the royalties we owe go down.

- Decrease (credit) Cash. Since we have to pay it out, the cash on hand also goes down.

There is no net effect on your company’s value or profitability, and as we look back, we can see that most of the impacts on value and profitability happen early. After royalties, but before other expenses, the transaction in our example has grossed $90,000 in profit and increased the value of the company by the same $90,000. We can also now easily see our reserve balance, and the level of pre-paid royalties – which is negative here because we did not include the creation of the initial advance.

Basic Concepts of Royalty Accounting

A royalty agreement will define the methods for determining royalty payments for a given property. The methods may be based on any of these standard principles for royalty accounting and calculation:

Gross Revenue Payment – The royalty amount due is a percentage of the total income before taking any other expenses into account.

Net Revenue Payment – Royalties are based on the income earned after expenses. For example, in the publishing world, writers are paid according to sales of a title only after the cost of printing and marketing has been paid.

Price Per Unit Payment – These are flat amounts paid for a song or a book within a specific format. Songwriters are often due a flat rate amount for each CD sold, and a different amount every time a song is played on the radio.

Guaranteed Minimum – This means a minimum amount is paid per royalty period, even if no royalties are earned. If royalties exceed the minimum, a greater amount will be paid.

Royalty Accounting Columns and Considerations

In addition to the method of royalty accounting, a contract will list all the considerations that may augment or detract from payment. Understaning proper royalty accounting is essential for accurate financial reporting. Some examples are:

Royalty Advances – These payments are given to a creator before they are actually earned, meaning that the royalties earned are balanced against the advance until the advance amount is paid off. The unearned balance will appear as a negative balance forward until the earn-out point is reached.

Monthly Royalty Expense – Typically, royalty payments accumulate over a few months. A publisher or licensee will account for the royalties owed by listing monthly royalty expenses within their royalty accounting program.

Subsidiary Rights Income – Companies often sublicense their properties to others for international distribution or for distribution in alternate formats. Payments from these subsidiaries must be included within the accounting system.

Author’s Charges – These count against royalty payments and include things like proofreading expenses, indexing, or perhaps a photo shoot.

Reserves – These are amounts held back by a publisher to insure against future sales returns.

Joint Accounting – This occurs when there are disparate sales between properties created by the same person or company. Although individual properties are often accounted for individually, it is sometimes more economical to merge the accounts.

These days most royalty accounting is fully automated. Depending on the size of the companies involved, it can be run by a single person or an entire department. Royalty statements, payments, and information are often shared through secure online portals, so royalty recipients can check their figures and sales on their own. It’s important for all parties to be comfortable with the system and to share an understanding of how royalty accounting works.

Software Solutions for Royalty Accounting

MetaComet® Systems makes royalty accounting much easier, by automating complex calculations and enabling easy and fast payments. Our Royalty Tracker® integrates seamlessly with your other accounting systems, dramatically reducing the time spent reconciling statements and updating financial ledgers. Sales Aggregator simplifies the process of importing different formats of sales files, while Royalty Portal gives your recipients 24-hour self-service access to royalty statements and other information, cutting down on confusion and customer support calls. Contact us to learn how our royalty reporting software can save you 90% of your royalty management time, while eliminating royalty errors and stress.

For a big picture look at the royalty management process, see our article: Royalty Calculation with the Royalty Management Lifecycle™. You may also be interested in our Rights & Royalties Definitions – Glossary of Terms, How Do Royalties Work? or Different Types of Royalties & How They Work, in addition to our Royalty Statements Guide.

David Marlin is the President and Co-Founder of MetaComet® Systems, a prominent provider of royalty automation tools. Since founding the company in 2000, David has spearheaded the development of a suite of best-in-class systems that effectively facilitate royalty processes for nearly 200 publishers. David has also served as the chair for The Book Industry Study Group’s Rights Committee and Digital Sales Committee.

Before establishing MetaComet Systems, David served as a technology consultant for renowned publishers, collaborating with notable companies such as Random House, Penguin, HarperCollins, Holtzbrinck, Macmillan, Scholastic, Time Warner, and many others. David holds both an MBA and a BA from Columbia University in New York.

Contact Us

"*" indicates required fields